Losses Are Very Hard To Recover

Brokers and advisors love to talk about the huge gains you have made in the past, are currently making, or will make in the future, in the market.

Hey, we get it, talking about huge gains and making a lot of money is a lot more fun than talking about big losses. We have previously discussed that huge gains may happen for the moment, but they can just as quickly and easily disappear if your assets are left “naked in the market.” You may get a good gain in one (1) year or two (2) years only to have the gains and part of your original principal wiped out with a big loss in year three (3). We have found that the vast majority of brokers and advisors love to talk about big gains, but they don’t like to talk about big losses. This blog was written for retirees, so your focus should be on risk mitigation first, and return second. Why? Because our clients, retired people just like you, do not want, and literally can’t afford, to lose any of the assets they worked so hard to accumulate. They want to make competitive rates of return, but they do not want to take excessive risks in doing so.

Right now, without even knowing it, because you have never been told by your broker or advisor, there is a high probability your current portfolio could lose -30%, -40%, or -50% if we have another stock market crash like the Financial Crisis of 2008. We believe there will be more stock market crashes during your lifetime; it’s not if there will be any more crashes, it’s when will the crashes happen and how severe will they be. So here are two (2) extremely important questions for you:

Question #1: “As a retiree would you be helped more by a +50% gain or hurt more by a -50% loss?”

Every single retiree client we ask this question replies they would be far more hurt by a -50% loss than they would be helped by a +50% gain.

Question #2: “As a retiree do you want to try and be rich or do you want to guarantee you will never be poor?”

Every single retiree client we ask this question replies they never want to run out of money, they never want to be poor.

So, based on the responses to these two (2) questions, if the overwhelming number of retirees don’t want to incur a large loss and want to guarantee they will not run out of money for as long as they live, why are their assets almost always positioned not to meet their goals? It’s simply

because their current broker or advisor, or the internet or a friend, tells them it’s OK to take risk. In fact, they tell you that you must take risk to get a high rate of return so you will succeed. They may not be telling you the truth. We have found during retirement, the more risk you take; the more you will lose in a stock market crash, the less income you can safely take out of your assets, and the higher the probability that you will run out of money during your life.

What would you do right now if you found out your current portfolio could lose -30%, -40%, -50%, or even more in the next stock market crash? You’d better not say you would just ride it out, because as a retiree, you no longer have the time to make up large losses. So, why are we harping on all of this? It’s simply because losses are very hard to recover from. Losses are much harder to recover than you would think. Losses are much harder to recover than what seems fair. Losses are far more painful than gains are pleasurable. And for retirees, losses are much harder to recover if you are taking income off of the assets and if you are paying fees.

Using common sense, it just seems if you lose 10% you should only have to make 10% to be back up to even, to recover fully. If you lose 20%, you should only have to make 20% to be back up to even, to recover, sound, right? If you lose 50%, it seems like you should only have to earn

50% to recover, to get back up to even. You lost 50%, you made 50%, BINGO – you’re even! Unfortunately, the math does not work that way. The bottom line is that every loss requires a bigger recovery gain than the original loss that was incurred just to break even. Many of you right now are thinking or commenting out-loud, “Say What?” But it’s true.

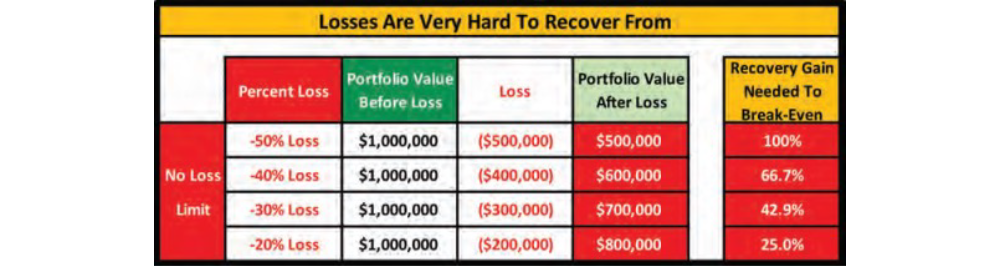

The chart below shows what we call the “No Loss Limit” range of potential portfolio losses. Here is the bottom line:

- If you lose -50% you must make +100% just to recover, if you lose -40% you must make +66.7% just to recover, if you lose -30% you must make +42.9% just to recover, and if you lose -20% you must make +25% just to recover. Does this seem fair? NO! But is it mathematically accurate? YES!

How easy is it to make +100%, +66.7%, +42.9%, or even +25.0%? And how long will it take to make it up? Are you guaranteed to recover your losses in a certain amount of time? What if you are taking income out and you suffer a big loss, is it even more difficult to recover and make the loss back up? What if you are paying fees and you suffer a big loss, doesn’t this make it even harder to recover? This is why all retirees must protect their assets against all potential large losses. Let’s say a hypothetical retiree has a $1,000,000 IRA and then loses -50% in a

Stock market crash. That $1,000,000 IRA is now down to $500,000. If the retiree makes a +50% gain on the $500,000, which is a big gain, has the IRA fully recovered? No, because +50% of $500,000 is only a $250,000 gain, so now the $500,000 IRA has only grown to $750,000.

The retiree is still down $250,000 from the original starting $1,000,000 IRA value. The retiree needs to make a +100% rate of return on the $500,000, to make a $500,000 gain, to fully recover and just be back to the $1,000,000 starting IRA value before the whole nightmare started.

And you cannot put yourself in this position during retirement.

The diagram below illustrates the comparison:

Imagine what it would feel like to suffer a -50% loss on your $1,000,000 portfolio, reducing your portfolio down to $500,000. Then you were able to earn +50% on the $500,000, and your portfolio only grew back to $750,000. Can you imagine what a disaster that would feel like? You must avoid all large losses.