Do Market Highs Mean Good Things For Investors?

The stock market has hit all-time highs. That should be great for investors. Over the last few years, how many times have you heard the stock market has hit all-time highs?

Probably a thousand times, sometimes you hear it twenty times in a day. Well, that should be great for investors. What we found is most retirees and soon-to-be retirees don’t feel like their portfolios have hit all-time highs. Do you?

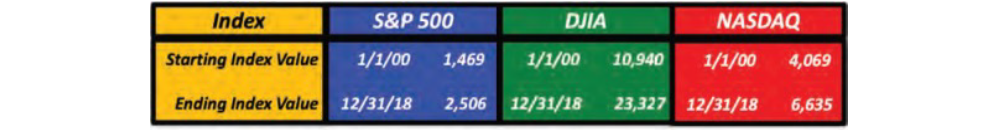

To understand the true effect of stock market high points, let’s examine the Standard & Poor’s 500 Index, the Dow Jones Industrial Average, and the NASDAQ, starting on January 1, 2000, and ending on December 31, 2018:

Based on this data, it looks like all three (3) major stock market indices did extremely well; and that is what the financial industry and your broker/advisor want you to think. It looks like a home run and makes you feel like all the risk you took was worth it because you made a ton of money. The problem is that these numbers are very deceiving. The following graph shows the actual compounded annual increases to all three (3) indices before any reduction for fees you would have to pay.

In January 2000, the Standard & Poor’s 500 Index was at 1,498. Then 19 years later on December 31, 2018, the Index was at 2,506, an increase of 1,008 points, which sounds like a huge gain. The problem is that’s only a 2.85% average compounded increase per year for 19 years. And it’s important to note this 2.85% average annual compounded increase includes the huge gains the stock market produced since 2009 in the longest bull stock market in history. If you think about all the volatility, you went through during these 19 years, all for a 2.85% average increase, ask yourself, if it was worth it? Did the risk equal the return? Was it worth going through two (2) separate approximately -50% market crashes for this type of growth? And maybe even more importantly, the 2.85% average annual compounded increase is without any reduction for fees. If you earned 2.85%, but paid 3% in fees like you may very well be, what was your real return? Right about -0.15%.

Then we can look at the Dow Jones Industrial Average. The Dow looked like it really made a lot of money. In January 2000, the Dow was at 10,940. Then 19 years later on December 31, 2018, the Index was at 23,327, an increase of an astonishing 12,387 points! Your brain right now is shouting “HUGE GAIN! HUGE GAIN! HUGE GAIN!” But alas, this isn’t the case. This is another example of financial illusion. The Dow had an average annual compounded increase of 4.06% per year for 19 years before any reduction for fees. How about the NASDAQ? The NASDAQ started in 2000 at 4,069 and ended on December 31, 2018, at 6,635. Looks like a big gain, but the NASDAQ had an average annual compounded increase of 2.61% per year for 19 years before any reduction for fees.

When retirees think about their assets, and what has happened to them since 2000, most people think they have done exceptionally well. Many thinking they have earned between 8%-12% on average every year. But to date, we have never seen one (1) person who has earned these types of returns during the time period we are examining.

Retirees think they have earned huge rates of return because:

- The stock markets as outlined previously have hit all new record highs.

- The index numbers look like they’ve made huge gains.

- You have made some very big gains in individual years.

- If you were working during this time period, your main growth was from your ongoing contributions.

- You have recovered from large losses.

- Your broker or advisor has told you that you have made huge gains.

Here is why you probably didn’t come close to getting an 8%-12% annual compounded rate of return:

- The data shows the S&P 500 Index averaged an annual increase of 2.85% during the 19-year time period between 2000 through 2018, the Dow averaged 4.06%, and the NASDAQ average 2.61% per year, all before fees.

- It’s very difficult to earn stock market rates of return, as we believe based on our research that less than 5% of all money managers can beat the stock market over any five (5) year-time period. DALBAR reported the average equity mutual fund investor earned 3.98% per year in stock mutual funds over the last 30 years ending December 31, 2016.

- You had to pay fees, in many cases 3% or higher per year.

- You lost close to -50% in 2000 through 2002 and then had to make a +100% gain just to recover, before you made any gain.

- You lost approximately -50% again in 2007 through 2009 and then had to make another +100% gain just to recover, before you made any gain.

The majority of retirees we have met with to provide them a 2nd Opinion About Their Money stated that just recently they have finally gotten ahead from where they were before the stock market crashed in 2000 and again in 2008. This assumes they did not make any more contributions to increase their portfolio values.

Sit back and think about these questions: Have you ever wondered why your account didn’t grow as much as you thought it should? Did you ever lose far more than you ever imagined? Did it ever seem like the only growth you realized was from the additional deposits you were making to your accounts? Did it seem like a long time from when you lost money to when you finally recovered? Did you worry about your money? Did you feel confused about your money? For most retirees, if they are honest, they have to answer “yes” to all these questions.

We recently performed a rate-of-return audit for a new potential client:

- In 2000, Bob had $1,500,000 in his portfolio.

- By 2002, his portfolio was worth $810,000 after the 2000-2002 stock market crash.

- By 2007, his portfolio was back up to $1,425,000.

- By March 2009, his portfolio was back down to $785,000.

- By December 2017, his portfolio was back up to $2,250,000.

- Bob feels like he has made a huge rate of return, his portfolio value is now $2,250,000! He started with $1,500,000 and now he had $2,250,000!

- Bob made a net 2.27% annual compounded rate of return.

- Bob was sad to hear he would have made more money if he would have bought 5-year CD’s.