Is The Stock Market Behavior Between 1999 Through 2013 Typical Or Abnormal?

After seeing the S&P 500 Index data for the time period between 1999 through 2013, many people asked us if this time period was unique or if it was the norm?

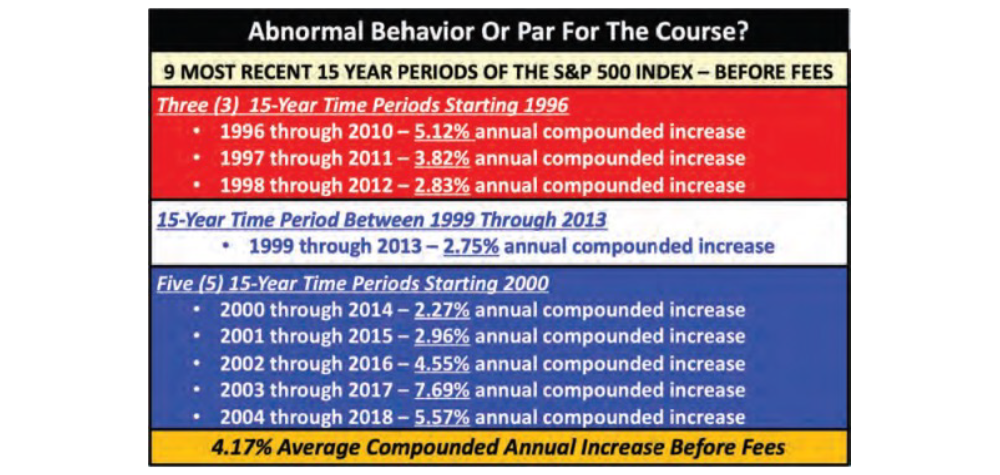

To answer this question, a more comprehensive analysis was performed. We went back to 1996 and reviewed every 15-year time period starting with 1996 through 2010 and ending with 2003 through 2018. The results from the analysis are eye-opening:

There are nine (9) separate 15-year time periods from 1996 through 2018. The average annual compounded increase to the S&P 500 Index during all time periods was 4.17% before fees.

- If you paid 1% in fees, and earned returns equal to the S&P 500 Index, maybe you only netted 3.17%.

- If you paid 2% in fees, and earned returns equal to the S&P 500 Index, maybe you only netted 2.17%.

- If you paid 3% in fees, which includes direct and hidden fees, like the typical retiree is paying, and earned returns equal to the S&P 500 Index , maybe you netted 1.17% per year.

What was really surprising was that there was only one (1) 15-year time period that yielded an average annual compounded increase of 6% or higher, that would be considered only minimally acceptable based on the amount of risk you had to take, and that was the time period from 2003 through 2017 – which included one of the strongest bull markets throughout US stock market history. During this time period the S&P 500 Index increased an average of 7.69% per year before fees. After fees, you were back down into the unacceptable level. The time periods we studied include a total of 23 years. For most of our clients, this is a good number to use based on their life expectancies. Anything else did not make sense to use. It’s important to understand the annual average increases to the S&P 500 Index were so low because of the very significant losses that were incurred in every one of the nine (9) 15-year time periods. The market did make a lot of money, but the large losses reduced the actual net after loss returns to these unacceptable levels.

The key is to remember that the stock market has always been volatile and always will be volatile.

The truths about the stock market include:

- The stock market will probably always have some periods of significant gains.

- The stock market will probably always have some periods of significant losses.

- The stock market will probably always have some periods of 0% growth.

- The stock market will probably not provide a consistent annual return that you can rely on for a consistent amount of income guaranteed for as long as you live.

- During retirement, you must protect yourself against stock market volatility.

By Dan Ahmad & Jim Files